Submitting reports

In CostPocket, reports are used to group and organize expense documents before sending them to accounting. Reports make expenses easier to review, help ensure compliance, and save time for both employees and accountants.

There are four types of reports in CostPocket:

- Expense

- Travel

- Mileage

- Payment Card (covered in a separate tutorial)

This guide walks you through creating and submitting each one.

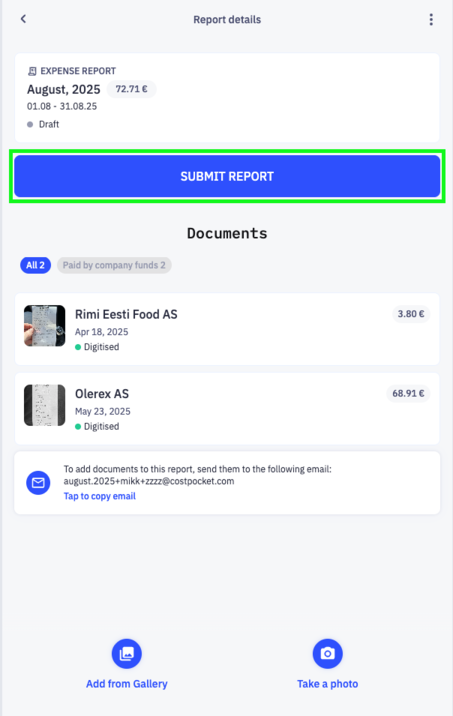

Expense Report

Collect receipts and invoices into one report and submit them together instead of one by one.

- Go to Reports > Add report

- Select Expense report and name it

- Add your receipts and invoices

- Click Submit Report when ready

Travel Report

Record business trips, add travel expenses, and let CostPocket automatically calculate the daily allowance.

Note for administrators: You can set a custom daily allowance rate under Settings > Accounting Configuration > Report settings. By default, the rates are set to the maximum allowed by local law.

- Go to Reports > Add report

- Select Travel report and enter trip details

- Add travel expenses

- Submit the report once it is completed

Mileage report

Track business driving and get mileage reimbursements calculated based on your company’s rates.

Note for administrators: You can define the rate and limit for employee mileage compensation under Settings > Accounting Configuration > Report settings. By default, the maximum rates allowed by local law are applied.

- Go to Reports > Add report

- Select Mileage and name it

- Add mileage entries for each trip.

- Submit when ready

Payment Card report

Reconcile company card transactions with expense documents automatically, saving time and reducing errors.

See the full tutorial here: Automated payment card reports